Know Why Having A Health Insurance Is Essential For You

Nowadays, the cost of healthcare facilities in the country is increasing significantly due to the ever-growing demand for medical services. How normal people will cope with the increasing cost of medical facilities. You will be left with only one option that is having a health insurance plan. One cannot plan and get sick but one can surely be prepared with a financial point of view. One of the ways to be financially prepared towards unknown health risks is by buying health insurance.

What is Health Insurance?

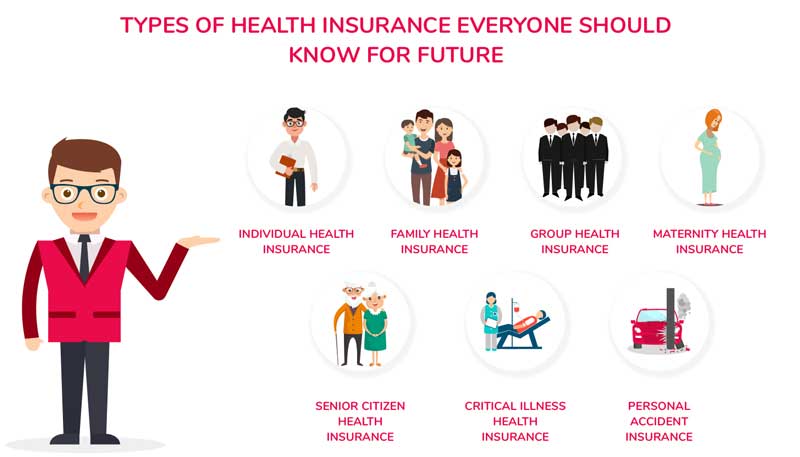

Health insurance is a kind of coverage that pays for medical expenditures acquired by the insured. Health insurance can compensate the insured for charges incurred from illness or injury or pay the hospital directly. There are different types of health insurance plans, such as personal health insurance, family health insurance, critical illness insurance, etc. health insurance is an essential part of financial planning and helps them in a crisis condition.

So, in our blog know why having a Health Insurance is an important aspect of your life:

There are many reasons to have a health insurance policy for example you can buy a family health insurance to take care of the medical needs of your family. However, the health insurance premium that one has to pay to avail a good insurance policy varies for different people and is based on various factors. Let us understand the importance and benefits of Health Insurance.

1. Growing Cost Of Medical Treatment

As medical services are getting expensive day by day, so medicinal costs have also risen. At the time of a medical emergency, the patient spends all savings which can affect their future plans for the family. Many reports claim that most of the people originally depend on their own savings when it comes to health emergencies.

2. Provides Financial Security

Once, you admitted to a hospital, there are various costs, which you have to pay which involves not only doctor’s fee but also charges for various tests, medically prescribed expensive medicines and sometimes even a re-examination fee. It is very obvious that you will pay off these charges from your future savings.

Some people believe that facilities provided by the government hospital are cheaper but most of the time it is not true. Private hospitals are well equipped with modern facilities and thus medical facilities provided by them are also expensive. If you have health insurance, you can take the benefit of best medical facilities as your health insurance will pay for the hospital expenses as long as it will be in the permissible limits of the insurance policy.

3. Changing Lifestyle

The advancement in technology has decreased our physical activities and this change in our lifestyle has made us more prone to a wide range of health diseases. Every time travelling, hectic work schedules, incorrect eating habits, quality of food and growing levels of pollution have increased the risk of developing health problems. So it is must us to have health insurance.

4. Get Benefit In Income Tax

If you buy a health insurance plan then it will give benefits in your income tax deduction. Those do pay health insurance premiums are also eligible for tax deductions under section 80D of the Indian Income Tax Act. Individuals up to 60 years of age can claim a discount of up to Rs 25,000 for the health insurance premium given for themselves or for their spouse or children.

One can also claim another Rs 50,000 as a discount if you buy health insurance for your parents aged 60 years and above. So overall, if you are paying the health insurance premiums for your senior citizen parents, you can avail a total discount of Rs. 75,000 (Rs. 25,000 + Rs. 50,000).

5. Coverage Of Pre & Post Hospitalisation Charges

Today most of the health insurance companies cover pre and post-hospital charges in some medical plans such as consultation fees, OPD expenses, diagnostic tests, x-rays, re-examination fees, medicines & equipment charges. In other words, this means that not only costs incurred with respect to main treatment are covered, but also those arising out of tests and consultation fees beyond that. However, there are certain time limitations to avail such coverage. Sometimes insurance provider often gives & covers transportation charges.

6. Provides Cashless Facility During Medical Emergency

Most of the hospital are associated with health insurance companies. At the time of medical emergency, insurance company provide a cashless facility with their health insurance policies under certain conditions. This can be very beneficial as in case of a crisis, the insurer pays for suitable expenses directly to the hospital, therefore policyholder doesn’t have to bear the expenses from his or her own pocket.

This cashless feature guarantees that the customers do not have to arrange immediate cash when an emergency occurs. In many cases, a third-party administrator pays the bill instantly to the hospital.

7. Additional Benefits Of Health Insurance

Other benefits of health insurance include ambulance costs, coverage for day-care operations, coverage for health check-up, medicines and vaccination charges. Many medical insurance plans offer period health check-ups free of cost under certain conditions. In many cases, even these check-ups are covered through a cashless mode apart from medical emergency service.

Right Age To Get Health Insurance

Many people ask at what age they should buy any health insurance plan or policy, is there any right age? Well, there is no exact age of buying health insurance as you can not predict the occurrence of your medical emergency or any disease. But, if you buy a health insurance plan at an early age, you will have to spend less on the policy. Premiums for a health insurance policy increases with growing age as many health problems develop as you grow old. Premiums for health plans are decided by the age, medical history, where you live, what kind of job you have, etc of the insurance holder.

So, it is your duty to be responsible for your health and start saving and financing early in suitable health insurance.

Sources: Special.ndtv.com, Rediff.com